Unser Versprechen

Mehr Frequenz und Kunden durch erfolgreiche Angebotskommunikation

Mit der lokalen Media-Strategie von prospega die Mediakanäle – von Haushaltswerbung, digital Advertising, OOH bis ATV – optimal für Ihre Zielgruppe aussteuern.

Prospega: Mediaagentur für lokale Angebotskommunikation

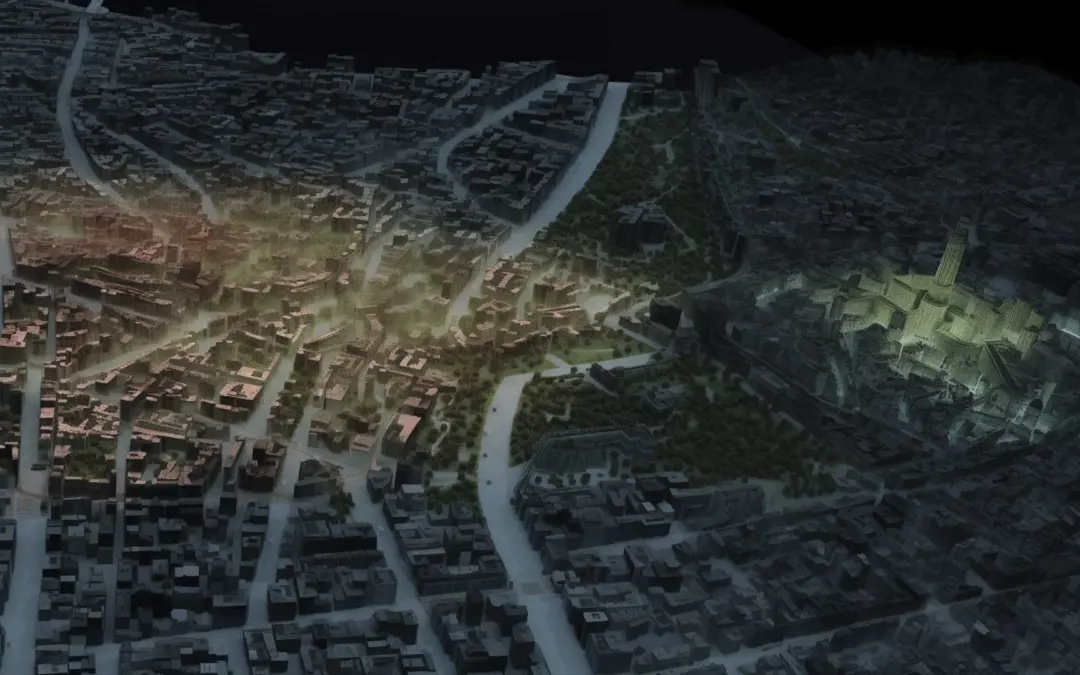

Unsere Stärke liegt in der Analyse multidimensionaler Datenräume wie Zielgruppenpotenziale, Wettbewerber und lokale Mediareichweiten. Dadurch schaffen wir die ideale Grundlage für die optimale Verteilung Ihres Mediabudgets in Kanälen wie Print, Außenwerbung, digitale Werbung und Audio. Von der Datenanalyse über die Buchung bis hin zur Abrechnung übernehmen wir die Verantwortung für den Erfolg Ihrer Werbekampagnen und sorgen dadurch für eine effektive Angebotskommunikation.

Unser USP

Die Zielgruppe immer im Blick

Datengetriebene Kampagnen, perfekt auf Ihre Zielgruppe zugeschnitten!

Unsere Stärken

Ständige Innovationen für Ihren Erfolg

prospega: Ihr Partner für lokale Medienwerbung und Erfolgsgeschichten!

Bei prospega sind wir stolz darauf, Ihr zuverlässiger Partner für lokale Medialösungen in Kombination unterschiedlichster lokaler Medien – von Displaywerbung, über klassische Printwerbung bis hin zur reichweitenstarken Haushaltswerbung zu sein. Nehmen Sie Kontakt mit uns auf und lassen Sie uns gemeinsam Ihre Erfolgsgeschichte schreiben.

News

Fragen und

Antworten.

FAQ

Welchen Raum kann ich über die Agentur prospega abdecken?

Wo finde ich erste Basisinformationen zu Einwohnern und Altersstruktur in meiner Planungsregion?

Informationen auf Kreisebene auf Basis der Statistiken der Landesämter für Statistik finden Sie unter: Prospektverteilung

Ich suche einen Dienstleister auf Augenhöhe, der mich in meiner Sprache berät. Ist prospega dieser Partner?

prospega Kompetenz

Digitalwerbung

Prospektwerbung

Printwerbung

Mediaplanung